The Four Top-Tier Travel Credit Cards I use

Amex Platinum, Chase Sapphire Reserve, Capital One Venture X, and Citi AAdvantage Executive World Elite Mastercard

In this article, I’ll provide a comparison of four premium travel-oriented credit cards that I use: American Express Platinum, Chase Sapphire Reserve, Capital One Venture X, and Citi AAdvantage Executive World Elite Mastercard. I'll evaluate their rewards programs, annual fees, travel rewards, and more.

I don't suggest you go out and get these all these cards but rather get a sense of what benefits these different cards offer and optimize the value you receive from any one of them.

I happen to find value in all four but if I had to drop one right now it would be the Venture X - except they have some features such as virtual credit card numbers that I rely on heavily for paying for recurring charges. This way each merchant gets their own card number and if my card number is replaced nothing happens to my billing.

So let's get into it.

Note, my main frequent flyer program is American (was Alaska) and they are part of the Oneworld alliance. If you are a Delta or United person (SkyTeam or Star Alliance) look for cards that cater to these programs. You’ll often find similar premium cards that have lounge access and allow you to earn status qualifying miles with credit card spend.

In case you did not know, the Airlines make more profit on credit cards and miles than selling revenue-generating tickets!

This video is an excellent overview of how Airlines became banks

In addition to these cards, I have other cards that I use for specific merchants due to the point earning and redemption value:

Chase Amazon Prime Card - earn 5x points on all Amazon purchases

Apple Card - earn 3% cash on all Apple purchases

Capital One Quick Silver Rewards - Lora’s main card, 1.5% cash back on all purchases

Here is how I allocate credit cards to purchases:

Travel and Dining = Chase Sapphire Reserve

Apple Products = Apple Card

Amazon = Amazon Card

All other purchases = Capital One Venture X

I will also pay for federal estimated taxes on the Citibank Elite World Mastercard so that I can earn American Airlines Executive Platinum status more quickly which translates to Oneworld Emerald and gives me similar benefits on Alaska Airlines as MVP 75K.

I have these cards so you don’t have to… yes, they are all expensive to own, but in my case, they pay for themselves (see analysis at the end) because I would normally pay for specific things or value specific benefits such as:

Lounge Access - American Lounges (includes Alaska Airlines) costs $650 a year or $550 if you are Executive Platinum ($600 to renew). The Citi AAdvantage Executive World Elite Mastercard cost $450. So, for $200 less to own the cc per year and you get up to 10 authorized credit card holders who all get American Lounge access (but not Alaska).

Primary Rental Car Insurance benefits - when traveling internationally the Chase and Capital One and Citibank cards cover you (Amex does not). Primary rental car insurance covers damage or theft of a rental car without involving your personal auto insurance policy first.

Travel Delay and Cancellation Protection - these cards will cover a reasonable amount of travel delays and protections saving you from having to purchase separate insurance. Chase has a great set of benefits.

Beyond that, you can see all the unique benefits below. Amex is particularly interesting in their money-saving products and it does take some work and planning to get 100% of the benefit.

If you have an American Express corporate card, you should know that as a Platinum Card holder, you can get $150 off your annual dues. This program is called the Corporate Advantage Program

A note on credit - all these cards require excellent credit. Achieving excellent credit is not all that hard, except for one unknown rule. You never want to carry a balance of more than 30% of your credit limit on any one card. If you have a credit limit of $10,000 on a card, try not to go over $3,333.00. I pay off my cards a few times a month to keep my balance low and just spread out my spending across a few cards. The penalty is higher if you don’t meet the 30% utilization rule on one card vs having many open lines of credit.

What is credit utilization?

Credit utilization is the amount of your available credit that you’re using. For example, say that you have a credit card with $10,000 in available credit, and you spend $3,000 during a billing period. Your credit utilization would be 30%, since you’re using $3,000 of your available $10,000 credit line. Generally it’s recommended that you don’t utilize more than 30% of your available credit.

Why do card issuers care about credit utilization? Because it’s viewed as a good indicator of how fiscally responsible and high risk you are as a customer.

CreditKarma is a great service to monitor and achieve good credit (over 700 and ideally 780+).

Credit Card Rewards Program

Amex Platinum

Earn 5X points on flights booked directly with airlines or through American Express Travel

Earn 5X points on prepaid hotels booked through American Express Travel

1X point on other eligible purchases

Chase Sapphire Reserve

Earn 3X points on travel and dining worldwide (immediately after earning the $300 travel credit)

Earn 1X point on all other purchases

50% more value when redeeming points for travel through Chase Ultimate Rewards

Capital One Venture X

Earn 10X miles on hotels and rental cars booked through Capital One Travel

Earn 5X miles on flights booked through Capital One Travel

Earn 2X miles on all other purchases

Citi AAdvantage Executive World Elite Mastercard

Earn 2X AAdvantage miles on American Airlines purchases

Earn 1X AAdvantage mile on all other purchases

The best way to spend your credit card points is as follows

Chase - For any travel spend that earns you 3x points you net out to a 4.5x value since each point is worth 1.5 points towards travel or 1c = 4.5c. The benefit to using your credit card points to get airline tickets is these are considered revenue tickets so you will also earn airline miles.

A few times a year you can redeem points for Apple products with a 50% point bonus. This ends up being a good value as well.

Capital One - spend on travel

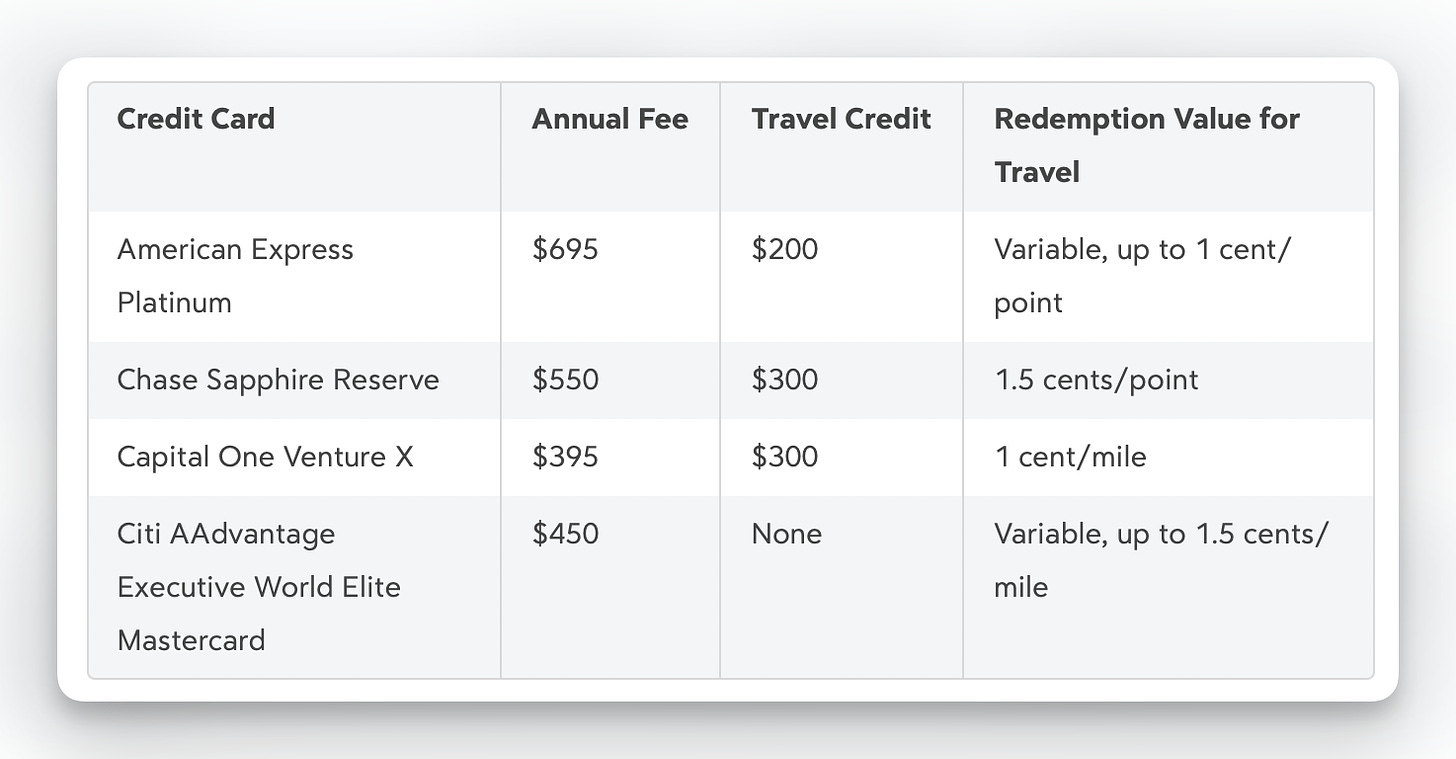

Annual Fees

The annual fees for the cards are as follows:

Amex Platinum: $695

Chase Sapphire Reserve: $550

Capital One Venture X: $395

Citi AAdvantage Executive World Elite Mastercard: $450

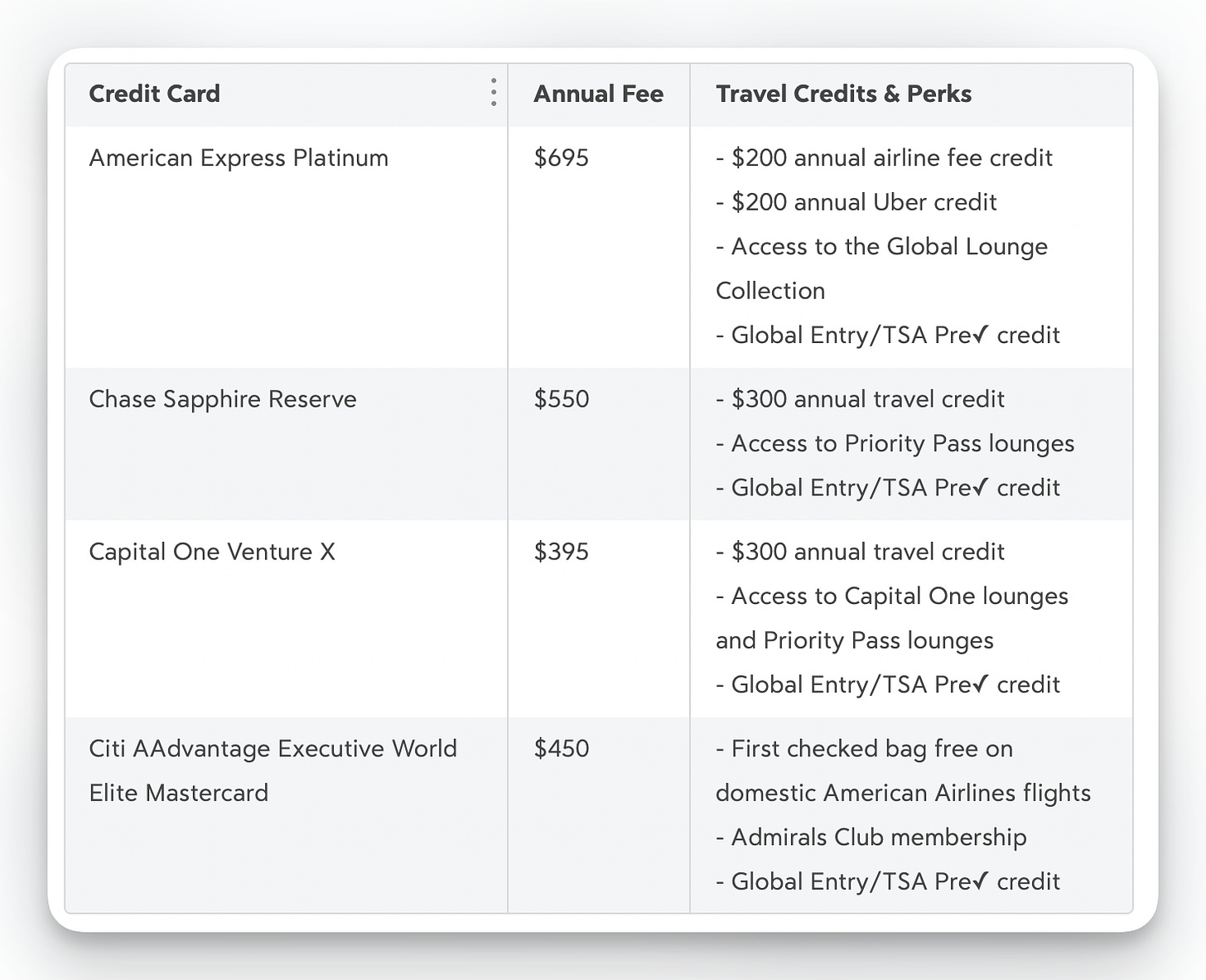

Travel Credits & Perks

Welcome Bonuses

Generally, cards have two kinds of bonuses. A welcome bonus (that can range) and also an annual bonus for achieving a certain amount of spending. Shop around for the best welcome bonus - if you are not in a hurry just wait as these tend to change.

Fees

The table above displays the annual fees, travel credits, and redemption value for travel for each credit card. Note that the redemption value for travel may vary depending on the specific redemption options available with each card issuer.

Maximizing your Credit Card Fees with smart benefits utilization

If you play this right, you can get each card to cover the fees (or quite close).

American Express Platinum (this is not a complete list, there are so many benefits, see this page)

$200 annual airline fee credit

$200 annual Uber credit (includes Uber Eats)

$240 Digital Entertainment Credit - Get up to $20 in statement credits each month when you use your Platinum Card for eligible purchases on: Audible, Disney+, The Disney Bundle, ESPN+, Hulu, Peacock, SiriusXM, and The New York Times

Up to $800 in cell phone insurance if you pay for your bill each month with your card - $800 per claim, a limit 2 claims per card account each 12-month period, and a $50 deductible applied to each claim

$100 Saks Fifth Avenue Credit

Global Dining Access by Resy - access to restaurants (it works)

Fine Hotels & Resorts Program - we use this a lot to get upgrades, late checkout 4pm and a resort or spa credit, premium wifi

$189 CLEAR Plus Credit

Access to the Global Lounge Collection, including Centurion Lounges, Delta Sky Clubs, and Priority Pass lounges

Global Entry/TSA Pre✓ credit (up to $100)

Complimentary elite status with Marriott Bonvoy and Hilton Honors

Discounts and benefits through the Fine Hotels & Resorts program

Car rental discounts and upgrades with Avis, Hertz, and National Car Rental

Chase Sapphire Reserve

$300 annual travel credit

Access to Priority Pass lounges

Global Entry/TSA Pre✓ credit (up to $100)

Complimentary DashPass subscription from DoorDash (at least 12 months)

50% more value when redeeming points for travel through Chase Ultimate Rewards

Primary car rental insurance coverage

Exclusive discounts and benefits through the Luxury Hotel & Resort Collection

Trip cancellation/interruption insurance

Capital One Venture X

$300 annual travel credit

Access to Capital One lounges and Priority Pass lounges

Global Entry/TSA Pre✓ credit (up to $100)

10,000 bonus miles each account anniversary year

No foreign transaction fees

Primary car rental insurance coverage

Exclusive discounts and benefits through the Capital One Travel program

Citi AAdvantage Executive World Elite Mastercard

First checked bag free on domestic American Airlines flights for you and up to eight companions

Admirals Club membership (access to American Airlines lounges)

Priority check-in, airport screening (where available) and early boarding when flying American Airlines.

Global Entry/TSA Pre✓ credit (up to $100)

Earn 10,000 additional Loyalty Points after you spend $40,000 in purchases during the qualifying status year.

First checked bag free on domestic American Airlines itineraries for you and up to 8 travel companions on the same reservation – savings of up to $540 per round trip

25% savings on inflight food and beverage purchases on American Airlines flights when you use your card

No foreign transaction fees

How does it work out for me?

These are the simple and easy benefits that I use on an annual basis. I have not included Global Entry for four people (each card covers $100 of global entry) and since we renew every four years, that’s about another $100 savings per year. In addition, the Amex Fine Hotels & Resorts Program often saves us money each hotel visit for food and beverage credits, free breakfast, free parking, free premium Wi-Fi, and upgrades we don’t pay for. So that can amount to hundreds of dollars a year.

I generally book all my hotels with the Amex card to receive these benefits.

Also, the international rental insurance saved my bacon once. Upon returning a rental to the Geneva airport the Avis people charged me $1000 for a nickel-sized door ding that I’m sure was already there… instead of arguing with them I just paid for it and left, and then filed a claim. I had a check in a week.

American Express

Annual Fee −$695

$200 Airline Credit

$200 Uber Credit

$240 Digital Entertainment Credit

$100 Saks Fifth Avenue Statement Credit

$200 Hotel Credit

$189 CLEAR Plus Credit

$150 Corporate Card Credit

outlay = + $584

Chase Sapphire Reserve

Annual Fee −$550.00

$300 Transportation Credit

$60 Door Dash Credit

$99 Complimentary Instacart+

outlay = - $91

Capital One Venture X

Annual Fee −$395.00

$300 Annual Travel Credit

outlay = - $95

Citi AAdvantage Executive World Elite Mastercard

Annual Fee −$450.00

$650 American Admiral Club

outlay = + $200

Result = $598 positive balance. That’s generous. I may not use the Saks Fifth Avenue credit but I do use all the others with just a little bit of planning.

Great post. Didn't know about the Corporate Advantage Program. That is just insane. You missed a couple of benefits though - Walmart+ (which also gets you Paramount Plus) which is an annualized savings of $155 - $215 (depending on whether you want to count Paramount+ separately). When I add that in, my outlay is closer to +$700

Why'd you divorce from Alaska mileage program? I'm kinda getting sick of them but it's so convenient being based in Seattle.